closed end fund liquidity risk

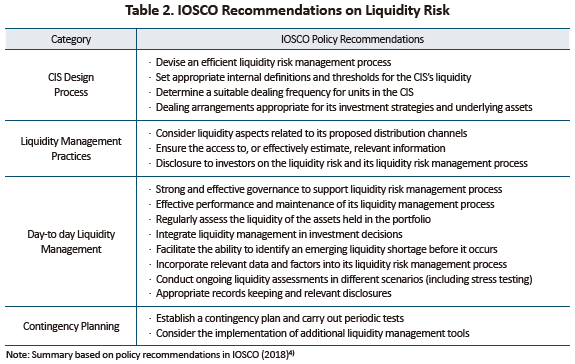

The SEC adopted Rule 22e-4 the Liquidity Rule requiring each registered open-end fund including open-end ETFs but not money market funds to establish a liquidity risk. Closed end investing involves risk.

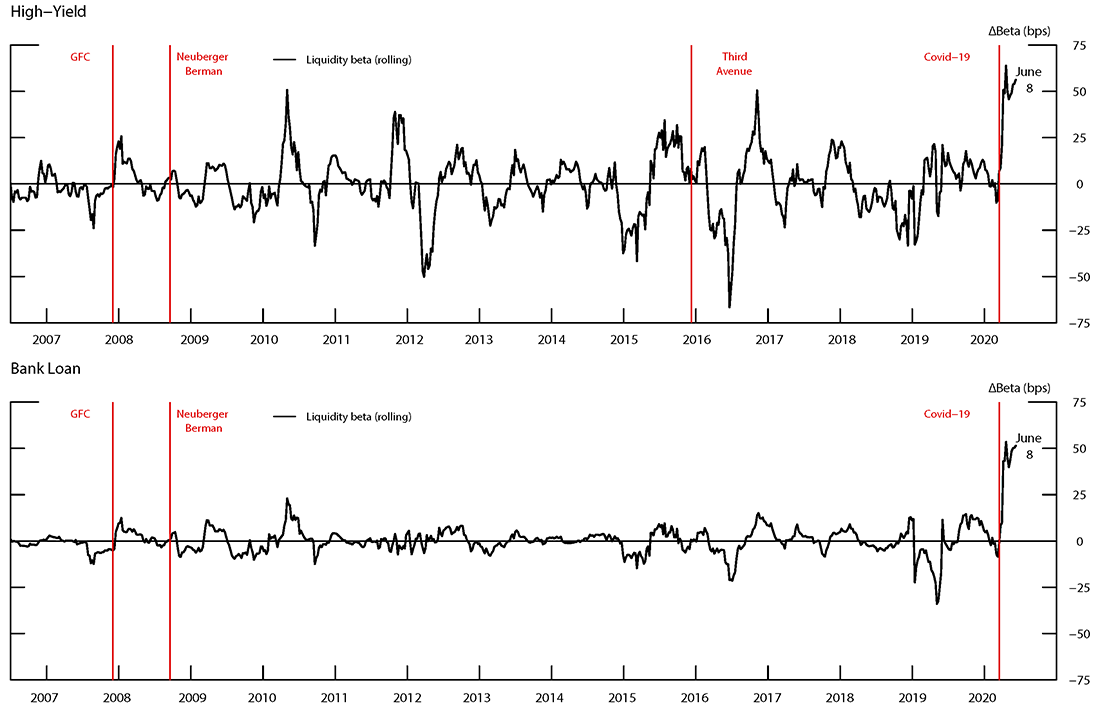

The Fed Monitoring The Liquidity Profile Of Mutual Funds

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

. A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Unlisted closed-end funds also provide limited liquidity. Less-liquid investments that could earn shareholders.

Closed-end funds remain the smallest part of the investment universe which brings both risks and opportunities. Pastor L Stambaugh RF 2003 Liquidity risk and expected stock returns. Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small.

Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. The term feature ensures NAV liquidity upon maturity. Additionally we find that the higher the liquidity risk of a closed-end fund relative to its underlying portfolio the larger the closed-end fund discount market price of the closed.

Open-end funds to establish a liquidity risk management framework tailored to its specific portfolio and risks. Traditional closed-end funds raise capital through an initial public offering IPO and issue a fixed amount of non-redeemable shares. At an open meeting held on September 22 the US Securities and Exchange Commission SEC unanimously approved a proposal that is designed to strengthen the.

Some closed end funds have more risk than others. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. Listed CEFs can offer intra-day liquidity.

Questions may be directed to the. J Pol Econ 111642685. The SECs Division of Investment Management is happy to assist small entities with questions regarding the liquidity risk management rules.

When investing in closed-end funds financial professionals and their investors should first consider the individuals. CrossRef Google Scholar Pontiff J 1997 Excess volatility and closed-end. The risks in their small size center around liquidity and are.

2 permit a fund to use swing pricing under certain circumstances. Like a mutual fund a closed-end. The investment return and principal value will fluctuate and investors shares when sold may be.

Closed-End Funds and Liquidity Open-ended funds have no limit on the number of shares they can issue and capital flows into and out of the funds freely as new shares are.

Macroprudential Liquidity Tools For Investment Funds A Preliminary Discussion

:max_bytes(150000):strip_icc()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

How A Closed End Fund Works And Differs From An Open End Fund

What Are The Differences Between Open End And Closed End Real Estate Funds Origin Investments

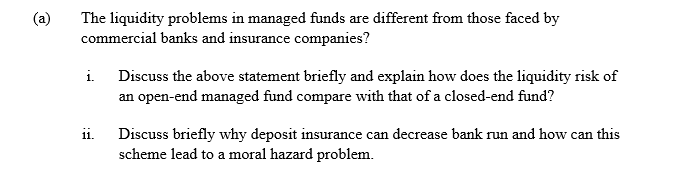

Solved A The Liquidity Problems In Managed Funds Are Chegg Com

Closed End Funds Definition Pros Cons Seeking Alpha

How Illiquid Open End Funds Can Amplify Shocks And Destabilize Asset Prices

A Closer Look At Closed End Funds Fundx Insights

Sec Proposes Liquidity Management Rules For Mutual Funds And Etfs Katten Muchin Rosenman Llp Jdsupra

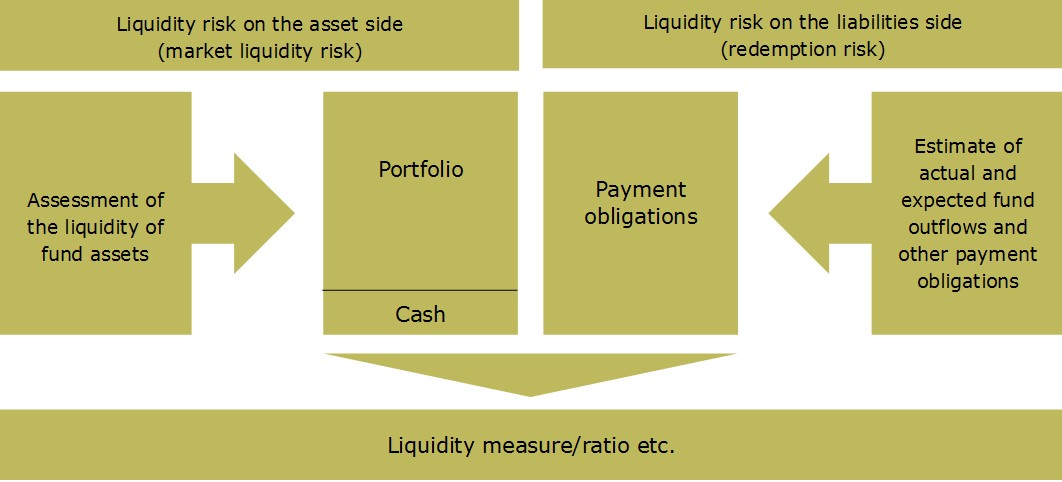

Bafin Expert Articles Investment Funds Dealing With Liquidity Risks

4 Unleveraged Open End Funds And Systemic Risk Download Scientific Diagram

Emerging Market Closed End Funds List Emerging Market Skeptic

Is Etf A Closed Ended Or An Open Ended Fund Quora

Closed End Funds Investment Guide Blackrock

Flowpoint Partners Llc On Twitter 4 22e 4 Aimed To Reduce Liquidity Risk Defined As The Risk That A Fund Could Not Meet Redemptions Without Significant Dilution Of Remaining Investors Interests In The

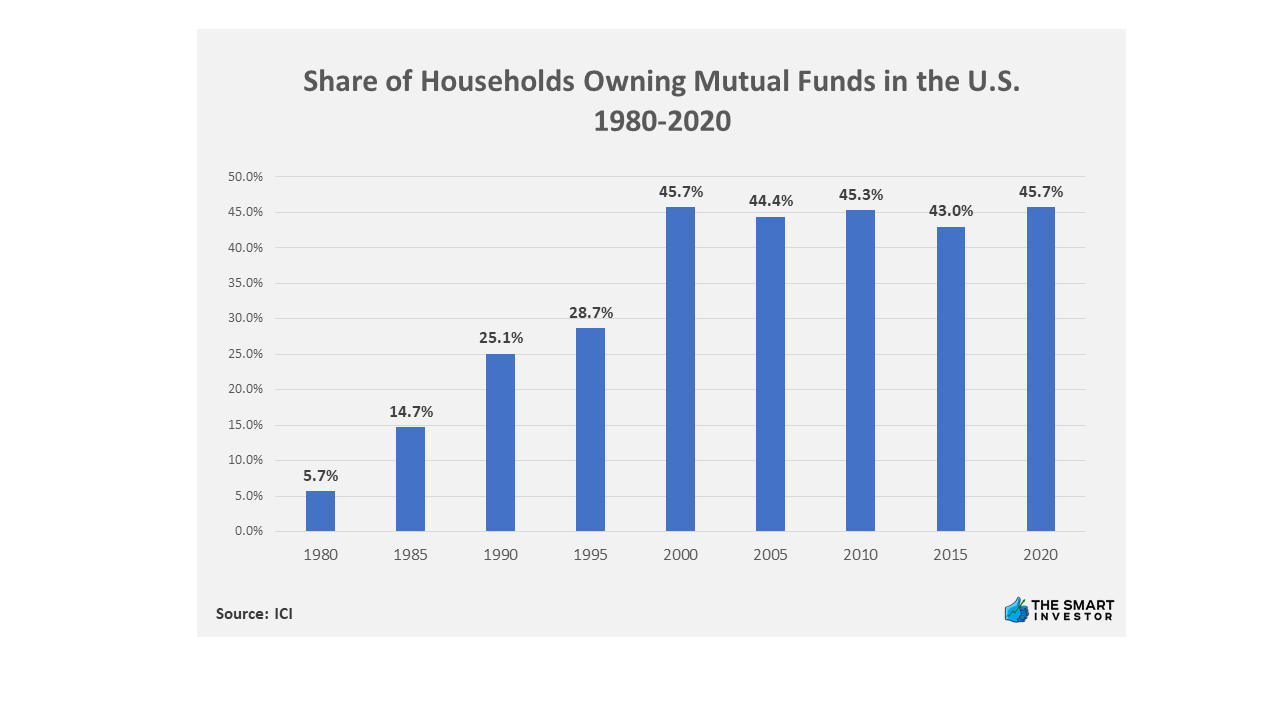

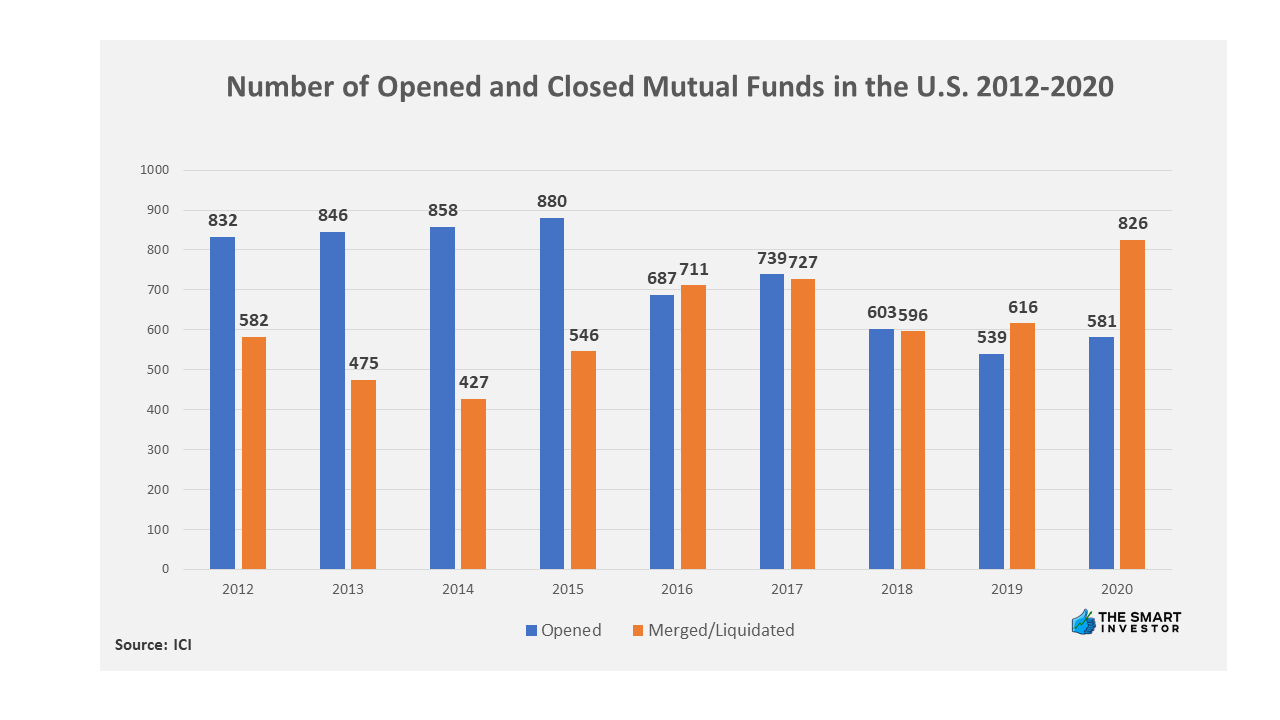

Closed End Funds Basics How It Works Pros Cons The Smart Investor

Securitize Artory Winston Launches Its First Tokenized Diversified

Liquidity Risk And Exchange Traded Fund Returns Variances And Tracking Errors Sciencedirect

Korea Capital Market Institute

Closed End Funds Basics How It Works Pros Cons The Smart Investor